Private Property Investment: What You Need to Know in 2024

With more housing supply and sustainable asking prices, 2024 may present more opportunities for property investment than in the past few years. While there has been a slight increase in the private residential property price index since the start of the year, it is nowhere near the optimistic leaps in 2023 and 2022. Comparatively, the first half of 2024 saw a price increase by 2.5%,- a drop from 2023’s 3.1% and 2022’s 4.2%.

Singapore Property Market Updates

Whether you are planning to buy a home or venturing into property investment to generate wealth, you must consider the four key factors that are impacting the current property market:

Persistently High Mortgage Rates

The general mortgage rate remains at around 4%. This rate is unlikely to reduce any time soon since the much-anticipated United States Federal Reserve rate cuts are progressing slower than expected.

With only one possible cut in September and more reductions in 2025, the high cost of homeownership could last for a while more. As such, some property buyers may choose to wait and see rather than enter the market.

More Supply of New Homes

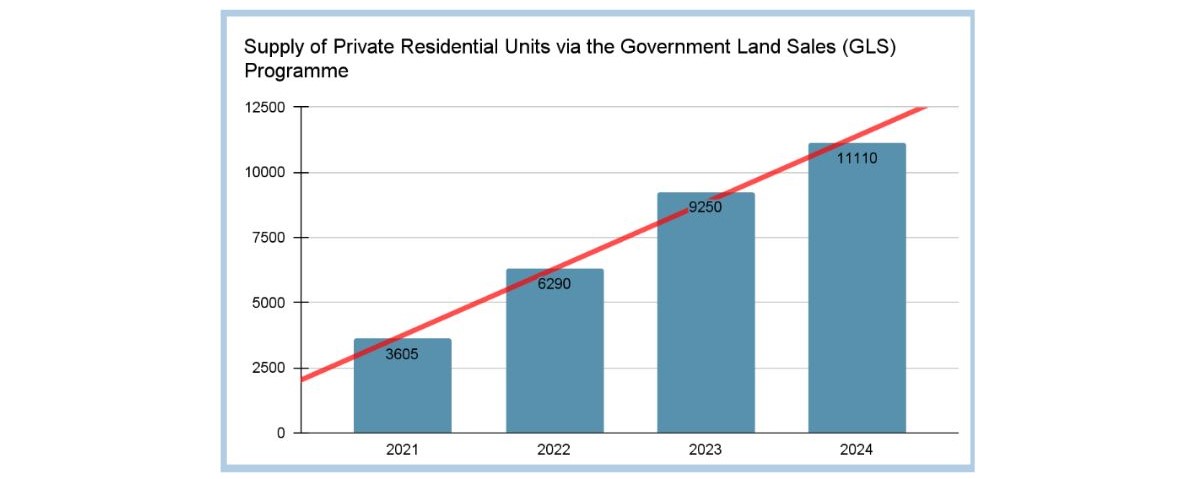

The steady supply of residential properties in 2024 (and next few years) is gradually meeting the pent-up demand. It is unclear when this rising supply would eventually bring the skyrocketing prices 'down to earth' but the declining condominium rental prices since July 2023 is a telltale sign that more new homes are available to ease rental demands.

In 2024, the Government has planned to release 11,110 private residential units via the Government Land Sales Programme, the highest number in a single year since 2013. There were 11,000 Build-To-Order (BTO) HDB flats launched in the first half of 2024 and 8,500 more to be offered in October.

Uncertain Economic Outlook

With geopolitical conflicts, on-going wars and news of major layoffs locally and globally, home buyers would exercise prudence even if the market presents favourable returns for property investment. Property purchases have a long-term impact on personal finances and cooling measures like the Additional Buyer's Stamp Duty (ABSD) and tightening of the Total Debt Servicing Ratio (TDSR) threshold can easily negate the excitement of investing in private homes.

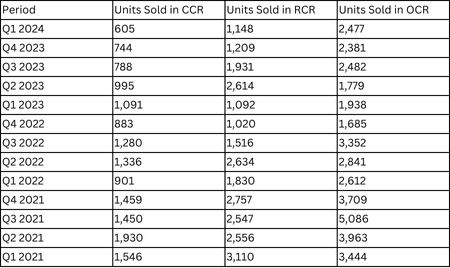

Housing Demands by Region

Private properties in the Outside Central Region (OCR) are gaining traction, while those in the Core Central Region (CCR) and the Rest of Central Region (RCR) are losing their appeal. Part of the reason is that the current pool of private home buyers comprises mainly locals and HDB upgraders who are price-conscious and tend to prefer OCR estates. The April 2023 property cooling measures that doubled ABSD rates have probably weed out foreign buyers who target luxury properties in CCR.

Number of Private Residential Units Sold by Region

Source: Urban Redevelopment Authority (URA)

New Condominium Launches in Q3 and Q4 2024

The stabilisation of the property market and possible price drop of residential homes are not indicators that the property scene is going downhill. Quite the contrary, these scenarios are creating a more sustainable marketplace for long-term property investment.

There are several new private property launches in the second half of 2024 and these are three that cautious investors may want to consider:

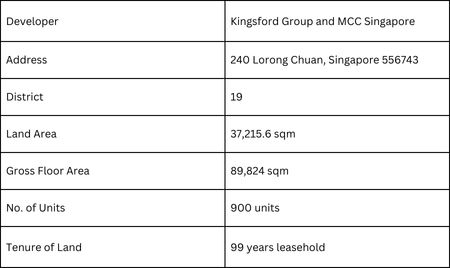

Chuan Park - 99-Year Leasehold Development

Chuan Park is the latest development by Kingsford Group and MCC Singapore in District 19. Conveniently located next to the Lorong Chuan MRT station along the Circle Line, this 99-year leasehold development comprises 900 residential units ranging from 2 to 5-bedroom unit types.

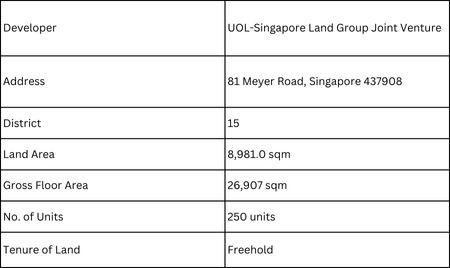

Meyer Blue - Luxury Development in the East

Meyer Blue is a freehold luxury development located in District 15. The single-tower condominium has 250 residential units and a full range of modern facilities. Meyer Blue’s strategic location offers easy access to ample urban amenities, public transportation networks, schools, and retail malls in the Eastern region of Singapore.

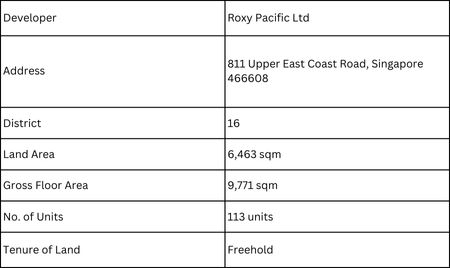

Bagnall Haus - Upper East Coast Region

Bagnall Haus is a rare and first freehold development in the Upper East Coast region in over a decade. Besides seamless connectivity, the development also boosts tremendous potential for capital gain once the URA rejuvenation plan is completed. Bagnall Haus is just a minute from Sungei Bedok MRT Station along the Thomson-East Coast Line.

Home

Home About Us

About Us